Saving for the future whilst living in the present isn’t always easy. There was a time when we paid a small amount into our children’s saving accounts each month, but somehow when the accounts expired I never found the time to start them up again. Now the children are older the cost of looking after them has increased hugely, thanks to seemingly endless amounts of music and sports lessons outside school, we pay around £350 in gymnastics fees for example.

It’s always in the back of my mind to start saving for them again, but as yet it’s one thing on my list I haven’t managed to action. Interest rates being so low doesn’t really encourage me either, but at least money in a bank account can’t be spent.

It’s not quite the same as saving monthly, but I do make my children save all their birthday and Christmas money so they will at least have those savings to help with buying a first car, house or University fees.

I am very conscious that with three children we probably won’t be able to help them out financially as much as we would hope so it’s important they save as much as possible now, and every little bit adds up. A great way to save for your child is with a Junior ISA and something I intend to open very soon!

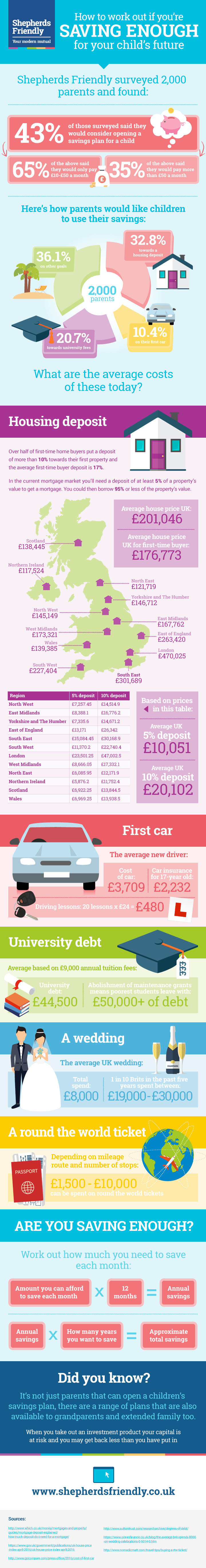

This infographic from Shepherds Friendly titled ‘are you saving enough for your child‘ shows how parents would like their children to spend their savings and how much savings our children might need. Did you know our children could leave University with a staggering £50,000 worth of debt, and the average wedding cost is £8000? That’s an awful lot of money for parents to save, especially if they have more than one child, and has definitely made me realise I need to start saving more for my children’s future now rather than keep putting it off.

Leave a Reply